+4143 497 38 38

Office in Switzerland

+357 25 222 933

Office in Cyprus

+971 58 530 7194

Office in the UAE

eng

- eng

- deu

Global dynamics to shape summer wheat prices

24

Jul 2022

Old crop demand woes will need global help to keep prices high

It’s July, which means the end of peak U.S. wheat export shipping season is less than two months away. But as harvest winds down across the Northern Hemisphere, there are a few hints about where wheat markets are headed in the weeks to come.

To be sure, the 2021/22 marketing campaign was a bit of a mixed bag for U.S. wheat exports. Total volumes lagged 19% behind prior year paces as China’s 2020/21 grains buying spree calmed down. China only purchased approximately 31 million bushels of U.S. wheat in 2021/22, compared to an estimated 118 million bushels in 2020/21.

But 2021/22 U.S. wheat export revenues through May 2022 surged 11% ($761M) higher than the same period a year ago to just shy of $7.6 billion thanks to stronger commodity prices this year. In terms of nominal prices, 2021/22 U.S. wheat export is the eighth largest on record and the largest annual wheat export earnings (in nominal terms) since the 2013/14 marketing year.

Prospects for next year’s U.S. wheat export volumes are likely to be constrained by smaller U.S. wheat harvests this summer. But if there are any troubles shipping freshly harvested wheat crops in the Northern Hemisphere this fall and global wheat prices remain high, another year of smaller U.S. wheat export volumes may once again be offset by higher prices earned by exporters.

Wheat’s old crop demand woes

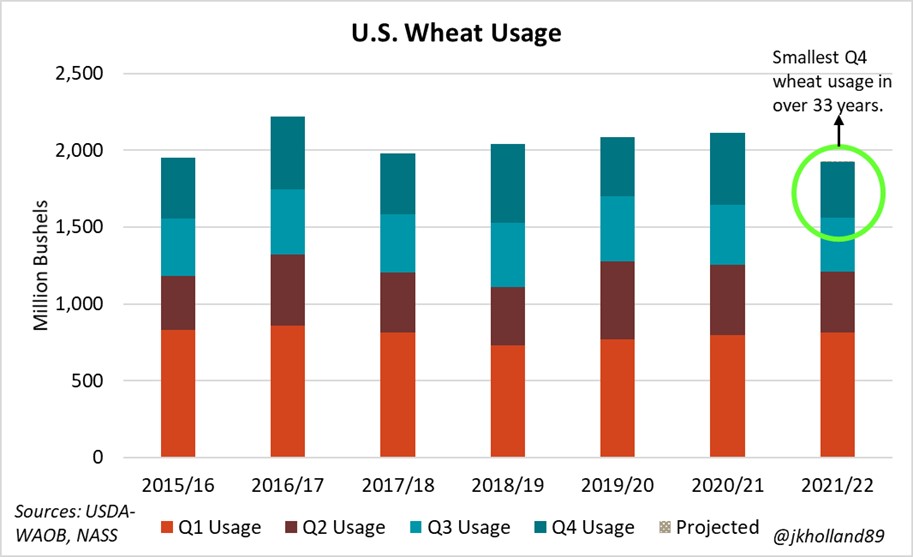

The primary theme behind wheat volumes and usage rates continues to be anemic demand amid a strong dollar and high global wheat prices. This was reflected in fourth quarter 2021/22 (March 1, 2022 – June 1, 2022 for wheat) usage rates, which dropped to a mere 364 million bushels.

While that was a 3% improvement from Q3 2021/22 usage rates, it was the smallest absolute usage volume for Q4 wheat consumption in at least 33 years. It’s no secret that U.S. wheat exports have lagged behind year-ago volumes in the absence of Chinese buyers. But a strong dollar does not seem to be doing any favors to U.S. wheat prospects, either.

Going into the 2022/23 marketing year, growers may be more likely to book wheat sales off the combine or shortly after harvest to ensure the best demand-driven pricing opportunities. U.S. wheat usage tends to see its largest volumes in between June 1 – September 1, with mixed results across the subsequent three quarters.

If wheat producers have any doubts about export markets, booking sales sooner rather than later may be the marketing strategy of preference in 2022. Domestic demand is likely to remain stable and could be the primary source of pricing opportunities in the 2022/23 marketing year. That means that U.S. wheat prices are going to be heavily dependent upon global wheat supply and demand dynamics.

Global outlook

With smaller exportable U.S. wheat supplies expected in 2022/23 and domestic demand slated for a 2.4% annual dip during the marketing year, U.S. wheat producers will be increasingly reliant on world headlines to keep prices high for the remainder of the year.

One of the key factors supporting wheat prices as summer winds down will be supply. While Black Sea forecasters are eagerly calling for the largest Russian wheat crop in the post-Soviet era, as of late June 2022, USDA remained conservative with its estimation of the crop, pegging it at 2.98 billion bushels – the third largest Russian wheat harvest in the post-Soviet era.

USDA projects Russian 2022 / 23 wheat exports one placeholder higher at 1.47 billion bushels, but that number is not yet set in stone. Dry weather in Russia’s southern regions – where the majority of its crop is produced – in June could restrict bumper crop expectations and push up global prices.

Western banking sanctions continue to be a constraint for Russian wheat exporters. While some wheat is still moving out of Russian ports, the added logistics costs, export quotas, and payment issues due to the sanctions stifled Russian export volumes in June.

Russia announced a new formula would keep Russian wheat prices competitive while the rouble remains strong. While the details were not readily available at press time, the modified formula is expected to ease the pain of a high rouble-dollar exchange rate to make Russian wheat shipments more competitive on the global market.

Australia and Argentina reported record wheat shipments to close out the 2021/22 year. But 2022/23 exportable supplies are forecast 13%-15% lower this year for both countries as Argentina battles a dry planting season and Australian growers face flooding.

Forecasts for Ukraine’s wheat crop are gradually shrinking amid dry weather and losing acreage in Eastern Ukraine to Russian military forces, though it likely matters as its ending stocks are slated to soar to a 27-year high as millions of bushels of grain remain trapped within the country.

Forecasts for European Union wheat production dominated early July 2022 headlines as a Reuters poll forecasted E.U.’s 2022 soft wheat production at 4.6 billion bushels. USDA’s current forecast for E.U.’s total wheat production stands at 5.0 billion bushels.

Forecasters have had a challenging time predicting total E.U. wheat production ahead of harvest this season after an imbalance of sudden drought and favorable growing weather in the region’s major wheat producing regions.

The E.U. soft wheat crop is slated to be 3.4% lower than last year’s haul amid the variation. Spain and Italy are expected to suffer substantial losses while results from top producer France are expected to be highly varied based on location. Romania and Bulgaria are predicted to harvest bumper crops, though heat stress continues to be a concern in Hungary.

Harvest outcomes for Germany, Poland, and Britain are still uncertain, but many traders are likely to increase forecasts following beneficial rains. Quality has been even more difficult than yield to predict and any substantial deviations from idyllic protein ratings could cause market upheaval across the E.U. over the coming year.

Cash bids on both hard and soft red winter wheat in the Plains and Midwest traded largely to a discount to futures prices yesterday, with little additional movement from yesterday’s trading session. Harvest pressure continues to be a key driver for cash wheat markets and many growers are content to wait to sell until they see a rebound in futures market prices.

The bulls seem to be besting the bears in the wheat market amid the dog days of summer. Improved access to Black Sea supplies and a production revival in Australia and Argentina are the biggest potential bearish factors facing the wheat market this summer.

But the bulls are a force to be reckoned with. Global wheat usage rates – primarily for human consumption – continue to rise even amid growing inflationary constraints. If Russia’s new export tax formula does not align with currency dynamics, yield losses threaten the Southern hemisphere’s crop, or spring wheat losses in the Northern hemisphere are larger than expected, farmers could see prices continue to rise into the fall.

Jacqueline Holland // Jul 18, 2022

https://www.farmprogress.com/commentary/global-dynamics-shape-summer-wheat-prices

05

May 2023

333

Raw sugar and cocoa prices reach nearly 10-year highs – the smart cube comments

Prices of raw sugar and cocoa touched 10-year...

30

Apr 2023

274

Raw sugar prices at 11-year high as adverse weather increases supply woes

Raw sugar prices are trading at a...

31

Oct 2022

520

Reduced tariff set for transportation of sugar beet by rail in Kyrgyzstan

Reduced tariff set for transportation of sugar...

31

Oct 2022

324

Crop Ships Are Still Leaving Ukraine Despite Russian Move

Ships loaded with crops are sailing from Ukraine,...

30

Oct 2022

318

Grain market braces for price flurry as Black Sea corridor in doubt

PARIS, Oct 30 (Reuters) - Wheat futures...

Any questions?